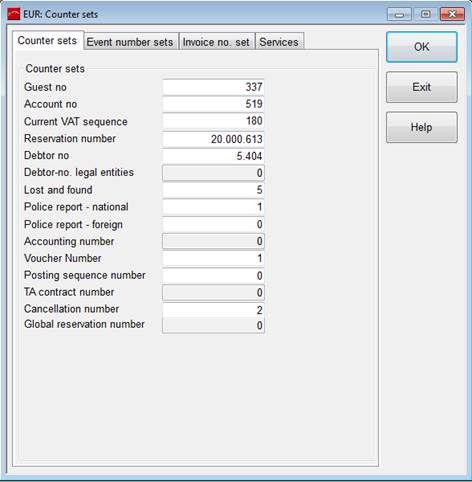

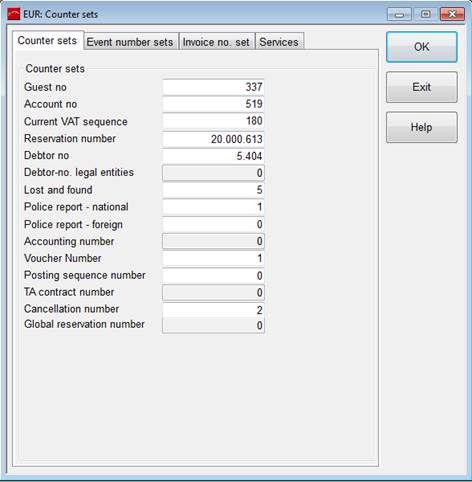

This program is required

•after completion of the initial installation – to reset the numbers, if necessary

•at the end of the year – to reset the numbers for the new year, if desired

•when changing the VAT/GST rates

Normally, the guest number, the account number and the current VAT/GST sequence number are not changed manually. The invoice number and the current VAT/GST sequence may be reset at the end of the year. In this case, please ensure, that the numbers are no longer than nine digits and that the first two numbers are identical with the respective year. I.e. you must not set the number to 0000000 year after year.

è EXAMPLE: A logical combination would be:

on 1st January 2010: 1000000

on 1st January 2011: 1100000

on 1st January 2012: 1200000

To avoid overlapping numbers, the new numbers must be larger than the numbers of the previous year.

Likewise you can define number sets and/or see the current number sets for events, invoices and services (see also Service Master Files).

Figure 139: Counter sets