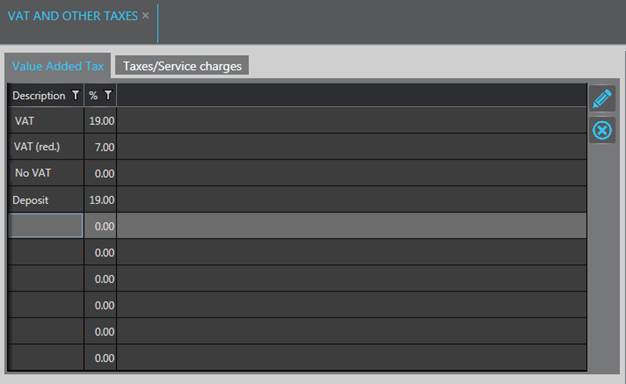

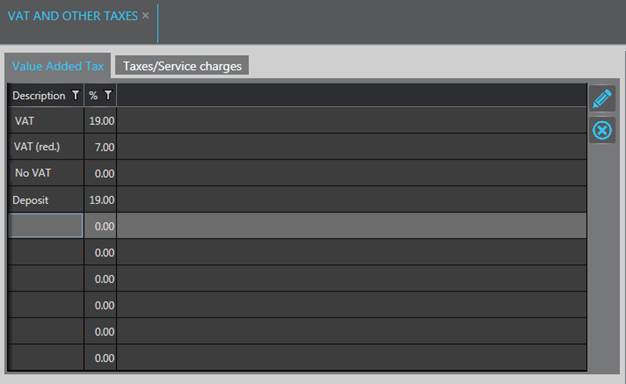

This layout primarily defines VAT or GST-rates applicable to the hotel, depending on the country and local regulations. The rates defined here are used in the service and package master files as required to ensure that each is charged with the correct taxation.

If registry key activate taxes [1340] is enabled, additional taxes and/or service charges can be entered in the second tab Taxes/service charges. These also vary considerably from country to country. E. g. Austria levies a service tax on accommodation charges and visitors’ taxes for guests. Enable registry key activate taxes [1340] to be able to enter

Taxes and service charges are calculated using the accommodation charges of a package and will be displayed in a separate column of the accommodation account in the revenue report. There are taxes which are again subject to VAT/GST and those which are exempted from VAT/GST:

•VAT/GST-exempt:

Often, VAT/GST are not applied to charges such as a tourist or municipality tax.

•Subject to VAT/GST:

In many countries, service charges are normally added to the net revenue and VAT/GST is then applied to the sum.

Figure 185: Definition of a value added tax