The split payment function can be used in case that certain clients and guests do not need to pay VAT and/or other taxes and their invoices should be issued accordingly. If you wish to use this function, please contact the SIHOT.Support Team as there are number of very specific configurations required prior to using the function.

Only very specific clients or guests are extempt from paying VAT and/or other taxes. The elegibility is defined in the guest profile:

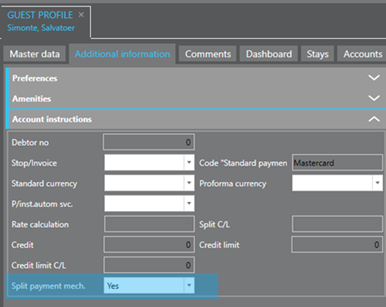

Ø Open the expander Account instruction (tab Additional information) in the respective profile.

Ø Change the entry in the field Split payment mechanism to Yes.

Figure 7: Definition of guest profile eligible for tax extemption

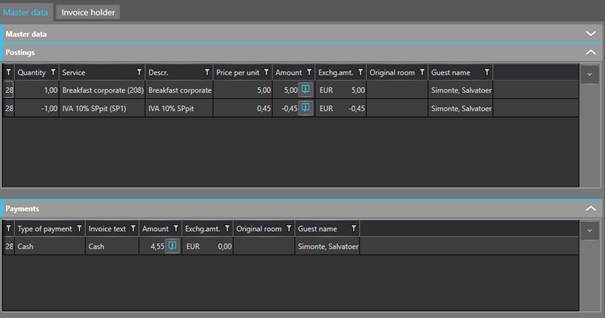

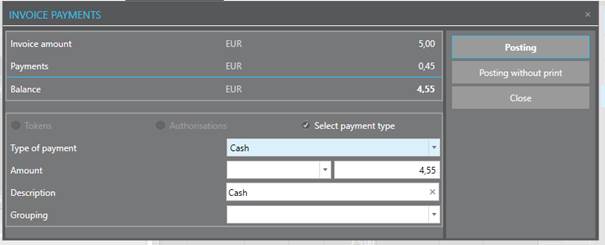

If the split payment mechanism is enabled and the invoice holder’s profile has been flagged accordingly (see above), the amount to be paid is automatically reduced by VAT and taxes (if configured) during invoicing.

Figure 8: Settlement without VAT

The tax amount is deducted in a negative service posting that has been set up for this purpose.

Figure 9: Payment with taxes deducted

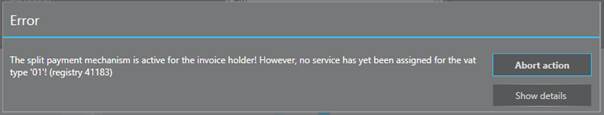

If no service has been defined for the tax reduction, the invoicing will be aborted with an error message. Therefore, the split payment mechanism cannot be carried out.

During invoicing, the split payments by the amount of the corresponding tax are posted in addition to the payment.