Base rate packages are derived from one package that solely determines the basic price of accommodation.

Note:

It is recommended that rates

are entered in seasonal rates rather than in one standard rate.

Tip:

If the rate in the basic

accommodation package is the same in all categories, enable the toggle-key Flat price. You then only

need to enter the rate once.

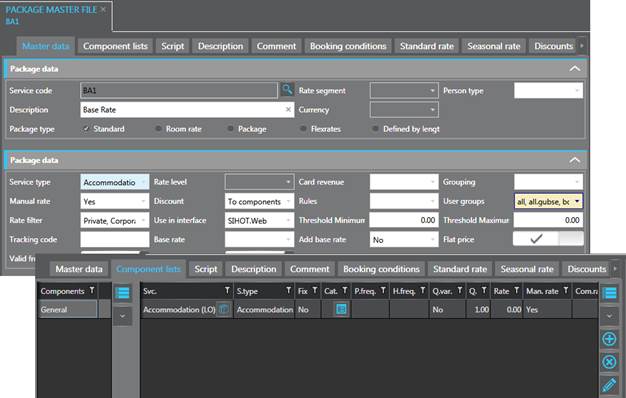

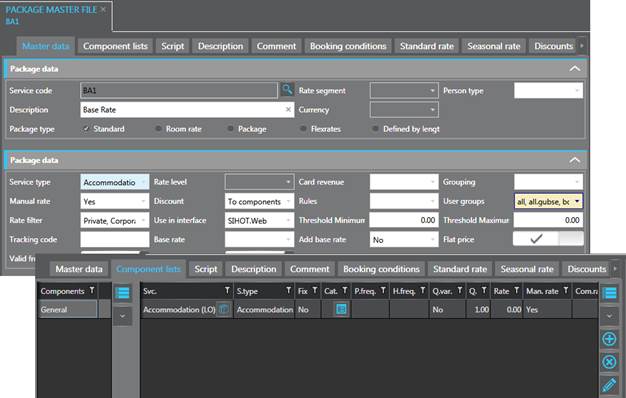

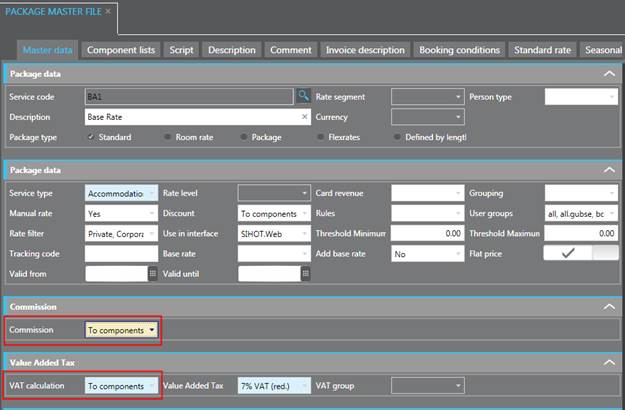

Figure 26: Base rate containing accommodation rates

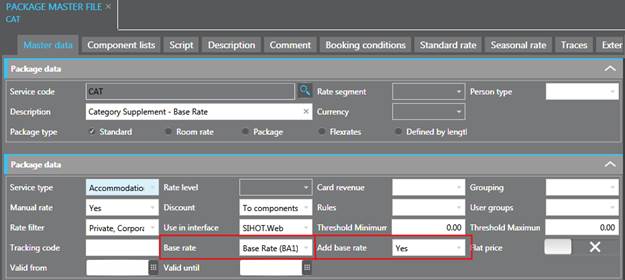

The second tier of the derived rates usually constitutes a supplement for different categories. These supplements are entered in a package with the following definitions:

•Field Base rate:

Select the package with the respective basic accommodation rate.

•Field Add base rate:

Enter Yes. This is the command for SIHOT to add the rates in this package to the prices of the base rate package.

No is used for discount-rates, which is a different type of package.

Figure 27: Derived rate with category supplements

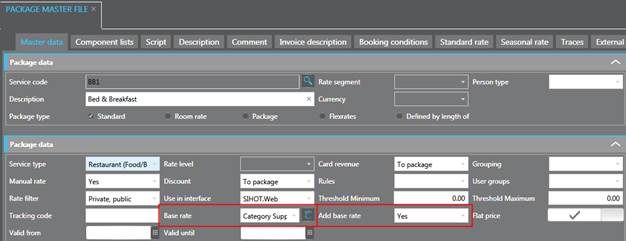

Additional tiers containing surcharges or discounts are entered in separate packages. You can either bundle a number of services together in one package or create a different package for each service. It is important, however, to base these package master files on a previous tier.

A bed and breakfast package, for example, is derived from the package containing the category-supplement, which in turn is derived from the basic accommodation package. The new package, therefore, is made up with the following definitions:

•Field Base rate:

Select the previous tier, i.e. the package with the category supplements.

•Field Add base rate:

Enter Yes. This is the command for SIHOT to add the rates in this package to the category supplement and the basic accommodation rate.

Figure 28: Package for bed & breakfast

NOTE:

For programming reasons, it is

not possible to combine tiers that are processed per room, per person and

per reservation. All tiers must be processed the same way.

Taxes and commissions are always calculated as per the definition of the base rate (tier 1 - accommodation). Therefore, the base rate should calculate taxes and commissions according to the component lists.

Figure 29: Defining taxes and commissions in the base rate