For electronic invoices to be transmitted correctly, users must enter certain details in the guest’s or company’s profile.

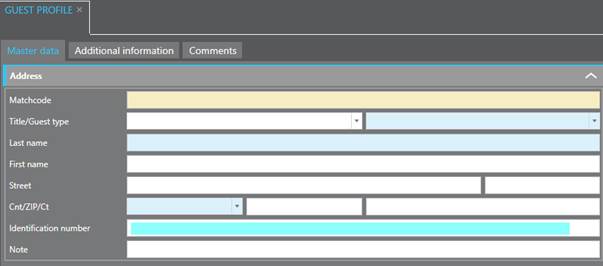

The expander Address must contain the relevant data depending on whether the profile belongs to a guest (i.e. a natural person) or a company (i.e. legal entity). However, these fields are to be completed for all guests/companies regardless of their nationality or country of residence.

|

SIHOT.PMS field name |

.xml file name |

Individual guests |

Companies |

|

Last name |

Denominazione/Nome |

compulsory |

compulsory |

|

First name |

Cognome |

compulsory |

not required |

|

Street with number |

Indirizzo |

compulsory |

compulsory |

|

Country |

Nazione / IVAPaese |

compulsory |

compulsory |

|

ZIP |

CAP |

compulsory |

compulsory |

|

County |

Comune |

compulsory |

compulsory |

|

District |

Provinca |

optional |

optional |

|

Identification number |

IVAcode |

not required |

compulsory |

Figure 1: Compulsory fields in a profile

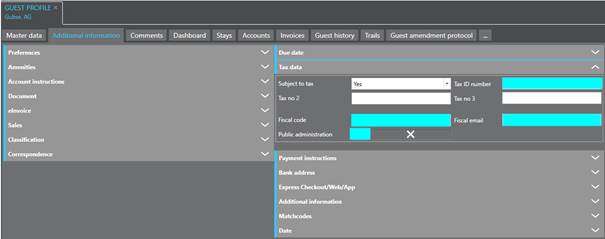

Further details must be entered in the expander Tax data (Tab Additional information) for Italian guests and companies:

•Fiscal code:

•This is the transmission code which allows for the exchange system to deliver the invoice thought the channel defined by the invoice recipient. It must be obtained from every Italian customer.

•Fiscal email:

•This is the fiscal email address (PEC). It must be obtained from every Italian customer.

•Tax ID number:

•This is the fiscal code that must be entered if the profile belongs to a natural person and must be obtained from every Italian customer. Companies usually do not provide this number, instead, they need to provide their VAT tax number (IVAcode), which is entered in the tab Master data.

•Public administration:

•If the invoice’s recipient is a body of the public administration, this must be indicated in the electronic invoice. This information must be provided by the invoice recipient and the toggle key must be activated accordingly.

|

SIHOT.PMS field name |

.xml file name |

Individual |

Companies |

Bodies of public administration |

|

Tax ID number |

codiceFiscale |

compulsory |

optional |

not required |

|

Fiscal code |

CodiceDestinatario |

compulsory if no fiscal email |

compulsory if no fiscal email |

compulsory if no fiscal email |

|

Fiscal email |

PecMail |

compulsory if no fiscal email |

compulsory if no fiscal code |

compulsory if no fiscal code |

|

Toggle key: Public administration |

|

not enabled |

not enabled |

enabled |

NOTE:

You can enter the fiscal code and the

fiscal email only after the profile has been created (i.e. after clicking

New).

Figure 2: Tax data for Italian guests/companies